With this feature, you can set dollar stops and targets across multiple positions.For example, lets say you got into an NASDAQ 100 /DOW Jones Futures Spread.

Each "leg" in that spread will have it's own P&L but those individual P&Ls are largely irrelevant. With legging out, you are able to exit the 2 positions simultaneously based on a dollar P&L amount.

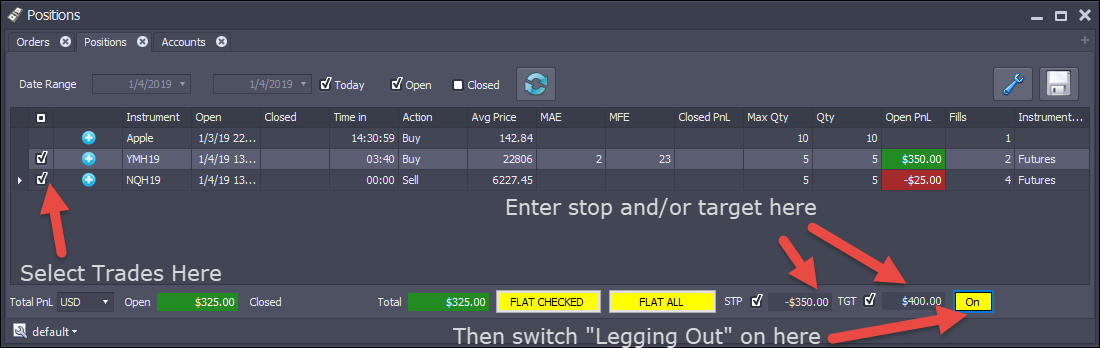

In the above example we are long DOW Jones and Short NASDAQ

Dow - Open PnL is $350.00

Nasdaq - Open Pnl is -$25.00

So the spread PnL is currently $325.00. If that PnL reaches the stop of -$350.00 or the target of $400.00 - then, the system will exit both positions at market. Note that P&L for a long leg is based on inside bid price (the price a market sell will hit) and the P&L for a short leg is based on the inside ask price (the price a market buy will hit).

The steps for trading a spread are as follows:

1.Enter the legs of the trade in Depth & Sales for the instruments.

2.Select the legs in position manager by clicking the checkbox on the right.

3.Enter stop and/or target amounts - you can have either or both.

4.Arm the button - it will go from "off" to "on" when you click it.

Note - there can of course, be more than 2 legs in a spread. Note also that as we are dealing with market orders, there is a chance of slippage. Note also that we only need the bid/ask price to move to your price in order to exit. This is not like a stop on an outright position where we need a contract to trade there first.