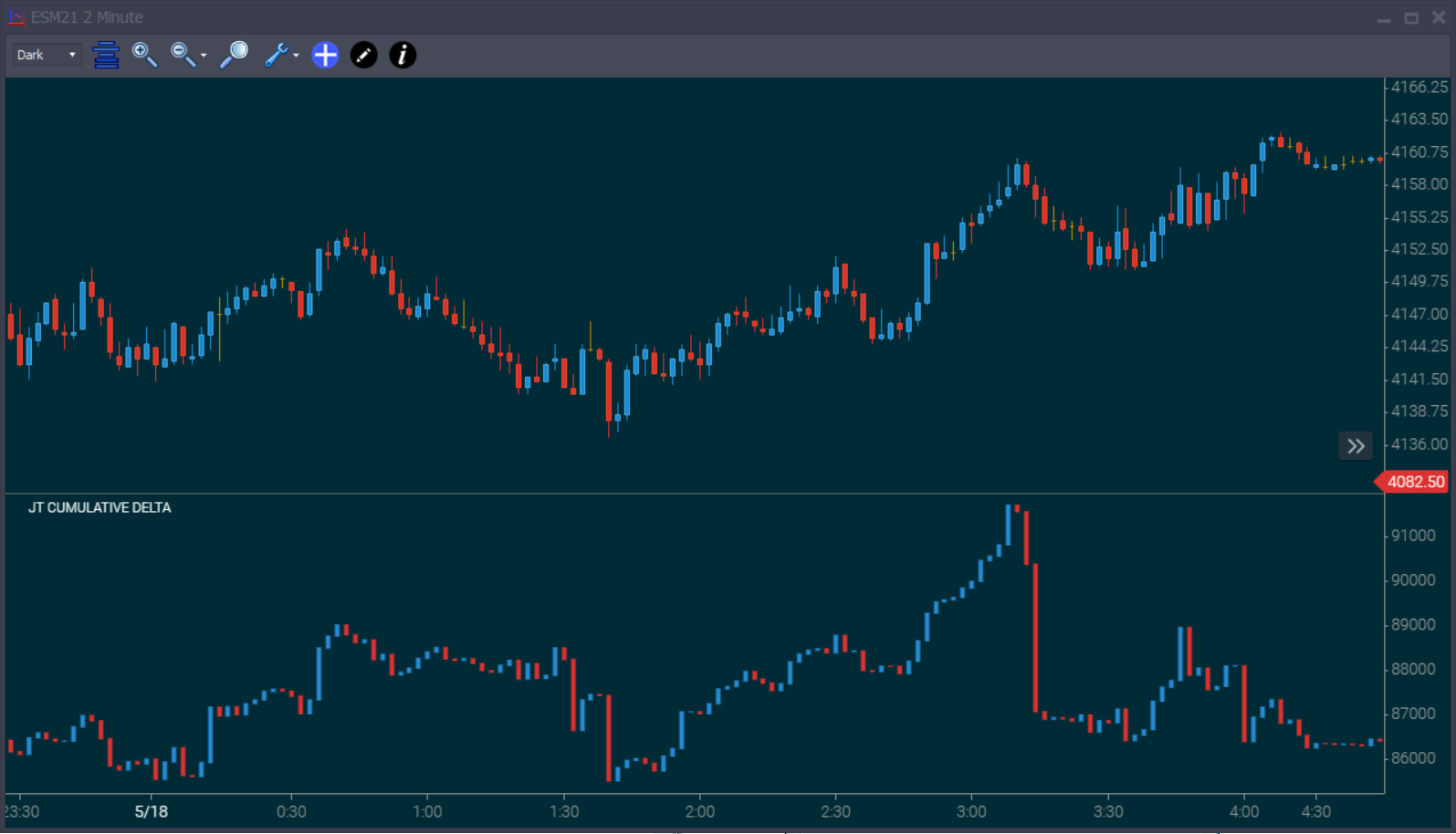

Cumulative delta shows the running aggregate numbers of buy market orders versus sell market orders. This will not be relevant in all markets. It all comes down to the level of urgency with which people enter the market. It would appear that the direction of interest rate products leans more on people sitting on limit orders and so delta looks irrelevant. Markets like S&P Futures seem to be more driven by market orders and there the cumulative delta is of more value.

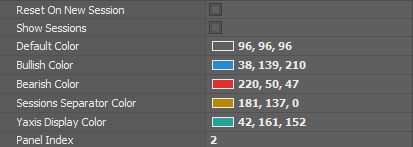

Settings

Reset on New Session - Check if you want the delta reset to zero at the start of each session. We don't recommend this as it can cause scaling issues. For example if delta at end of last session was +500k and you reset, then you will have 1 bar at +500k and the next at 0. Having that spread of data on the chart will smooth out the early days moves.

Show Sessions - Show session break line.

Panel Index - Which panel to put the Cumulative Delta on - in the above example the chart is on panel 1 but the delta on panel 2.